MEDICAL AND DENTAL EXPENSE MATCHING ACCOUNT

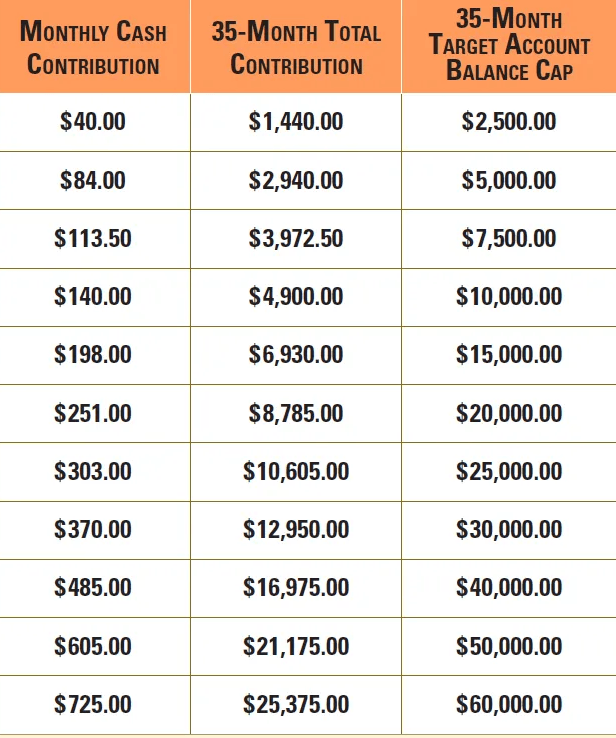

At Insurance Plan Pros, we offer a Medical and Dental Expense Matching account. This program helps individual, families and businesses save money to cover any type of medical or dental expense, then best of all, MATCHES it! It is similar to an Health Savings Account (HSA), in that you can access the benefits on a debit card, but unlike an HSA, the growth of your account is guaranteed and substantial. Clients receive an average of $2 or more in benefits for every $1 they contribute to the program on a monthly basis as the program progresses. Additionally, you can continue to contribute after age 65.

An Expense Matching account helps cover all out-of-pocket medical and dental expenses not covered by your health insurance or Medicare. It provides you with more freedom and medical purchasing power than any other product on the market. It can even be used for elective procedures!

Give us a call at 469-340-3300 to schedule a free consultation and we can explain in more detail how this program can save you money!

WHAT TYPES OF EXPENSES DOES THIS COVER?

- Elective Procedures

- Lasik Surgery

- Plastic Surgery

- Fertility Treatments

- Pregnancy Expenses

- Botox and other Dermatologic Treatments

- Hormone Replacement Therapy

- Ambulatory Services

- Podiatrists

- Chiropractic Treatment and Care

- Counseling Services

- Dental and Orthodontic Services

- Doctors Visits

- Prescription Drug Expenses

- Hearing Aids

- Home Health Expenses

- Hospital Expenses

- Hospital Equipment and Supplies

- Long-Term Care Expenses

- Medical and Dental Lab work

- Medical Services and Health Practitioners

- Opticians, Eyeglasses and Contacts

- Optometrists and Ophthalmologists

- Orthopedic Supplies and Prosthetic Devices

- Osteopathic Physicians

BENEFITS OF ANCILLARY COVERAGE

YOU CONTROL YOUR CONTRIBUTION LEVEL

Your monthly contributions never increase or decrease unless you want them to, and the growth rate of your account is guaranteed.

PLAN AHEAD FOR SAVINGS ON UPCOMING PROCEDURES

Plan ahead for large expenses like braces or an elective surgery to save 50% on out-of-pocket costs, then reduce contributions if needed.

PREPARE TO REPLACE DENTAL/VISION PLANS

Once you surpass your 35 months, use your account as a replacement for overpriced dental and vision plans.

PEACE OF MIND

An Expense Matching Account debit cards never expire, and replenish each time you use them, so you will always have money available to cover your medical or dental expenses.